pa inheritance tax exemption amount

The tax is exempt for any property owned by a spouse. Other Necessary Tax Filings.

10 Ways To Be Tax Exempt Howstuffworks

If the Joint Account was made within one year of death it is fully taxable.

. Ad Inheritance and Estate Planning Guidance With Simple Pricing. There is a flat 12 inheritance tax on most assets that pass to a sibling brother or sister. Life insurance is exempt from PA inheritance tax and federal income tax.

There is a flat 15 inheritance tax on most assets that pass up to nieces nephews friends and other beneficiaries. 12 for asset transfers to siblings. 31 1984 this exclu-sion is no longer signifi cant.

It is a four-and-a-half percent tax for direct descendants and 12 for siblings. Lets say that when you die your leave your home and investments to your children and that the net value of the inheritance is 300000. According to Pennsylvania Department of Revenue 2020 Tax rates on individually owned assets passing to beneficiaries at the death of a PA resident are as follows.

355 Fifth Ave 12th floor Pittsburgh PA 15222. Traditionally the Pennsylvania inheritance tax had a very narrow exemption for transfers between the spouses. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

Their tax rate varies depending on their relationship to the deceased. What is the family exemption and how much can be claimed. The deceased persons parents and grandparents.

In the event there is no spouse or child the exemption may be. In basic terms assets were exempt from tax only if the spouses owned them jointly. This included brothers sisters nieces and nephews and all others.

A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and stepchildren. Joint accounts which were made joint more than one year before death are taxed at one half of value. Federal estatetrust income tax.

Pennsylvania Inheritance Tax is 12 on property passing to siblings and 15 to everyone else. A rate of 15 applied to so-called collateral beneficiaries. Amount of PA Inheritance Tax Due from Other Heirs.

The estate tax is a tax on an individuals right to transfer property upon your death. The PA inheritance tax rate is 12 for property passed to siblings. Lineal descendant parents children grandchildren 45.

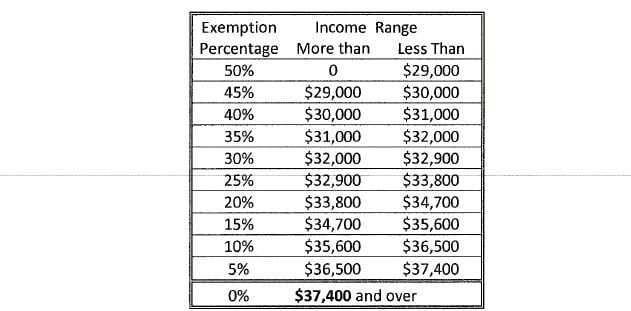

While the inheritance tax is state-specific the federal estate tax is another tax that must be considered. The PA inheritance tax rate is 45 for property passed to direct descendants and lineal heirs. The tax rate is.

The tax on Pennsylvania inheritance is calculated according to the decedents age. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. That is in the past the exemption didnt apply if the property was owned solely by one of the spouses.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. The Pa tax inheritance tax rates are as follows. Attorney fees incidental to litigation instituted by the beneficiaries for their benefit do not constitute a proper deduction.

Spadea of Spadea Associates LLC at 610-521-0604. Pennsylvania has various exemptions from inheritance tax. There is no special exemption amount and the applicable tax rates are.

A decedents children or grandchildren. With inheritance tax the person or organization that inherits the assets pays the taxes and they pay only on what they inherit. As a result all real estate and tangible personal property located within Pennsylvania is taxable.

Amount of PA Inheritance Tax Due from Siblings. The deceased persons children and their descendants whether or not they have been adopted by others as well as step-descendants. In Pennsylvania for instance direct descendants pay 45 on inheritances siblings pay 12 and other heirs pay 15.

If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption. The deceased persons childs spouse so. 45 for any asset transfers to lineal heirs or direct descendants.

The Pennsylvania Inheritance Tax is imposed on both residents and nonresidents who owned real estate and tangible personal property in Pennsylvania at the time of their death. The PA inheritance tax rate is 15 for property passed to other heirs excluding charities and organizations that are exempt from PA inheritance tax Data Source. 8 AM 4 PM Mon Fri.

The surviving spouse does not pay a. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500. A total of 45000 will be charged.

There are other federal and state tax requirements an executor will need to take care of like. The tax rate is dependent upon the relationship between the decedent and the beneficiary. For decedents dying after Jan.

Pennsylvania Inheritance Tax on Assets Passing to your Brothers Sisters Nieces Nephews Friends and Others. Payments are also exempt to the extent that the decedent prior to death did not. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating.

The federal gift tax has an exemption of 15000 per recipient per year for 2021 and 16000 in 2022. The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents. If an estate exceeds that amount the top tax rate is 40.

Up to 25 cash back Most immediate family members pay 45 inheritance tax on the property they inherit. Traditionally the Pennsylvania inheritance tax had two tax rates. Benefi t plans that are exempt for Federal Estate Tax purposes are exempt from the Pennsylvania Inheritance Tax.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. Class E beneficiaries are exempt from inheritance tax. There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax.

The PA inheritance tax would be 4 ½ of that or 13500 and the children would receive 286500 in value. 29 1995 the family exemption is 3500. And to find the amount due the fair market values of all the decedents assets as of death are added up.

If the decedent dies before the tax can be paid the heirs will pay the PA inheritance. 1 Any funds after. All other heirs excluding charitable organizations government entities and exempt institutions 15.

Family ExemptionThe family exemption is a right given to specific individuals to retain or claim certain items or amounts of the decedents property in accordance with Section 3121. Property that is owned jointly between two spouses is exempt from inheritance tax. 15 for asset transfers to other heirs.

For example if a husband owned a bank. If you have any questions about the REV- 1500 or the family exemption you should contact Gregory J. Sibling brother sister 12.

Since the federal exclusion was elimi-nated for estates of most individuals dying after Dec. In an attachment to the tax return. A full chart of federal estate tax rates is below.

Requirements For Tax Exemption Tax Exempt Organizations

Pin On Real Estate Information For Buyers And Sellers

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tax Planning Q A For Canadian Physicians Dr Bill

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Are Marriage Penalties And Bonuses Tax Policy Center

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

How Do Millionaires And Billionaires Avoid Estate Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What Is A Homestead Exemption And How Does It Work Lendingtree

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Will The Lifetime Exemption Sunset On January 1 2026 Agency One